ACA Policy

I. The Law

The Patient Protection and Affordable Care Act (PPACA), more commonly called the Affordable Care Act (ACA) is federal legislation signed into law by President Obama in March 2010. This comprehensive healthcare reform law aims to expand Americans' access to affordable healthcare insurance. Some of the changes resulting from the law are already in effect, and others will go into effect over a period of years.

The Individual Mandate became effective January 1, 2014 and requires most Americans to have medical insurance, otherwise they may be subject to a tax penalty. The Employer Mandate requires an employer with 50 or more full-time employees to offer affordable, minimal value health insurance to employees and their children up to age 26 and is referred to as the Employer Shared Responsibility (ESR). This portion of the law became effective January 1, 2015 and includes employer penalties and reporting requirements.

Employers subject to the ESR are required to measure an employee’s hours of service over a period of time and if the employee is determined to be full-time (for ACA: 30 hours per week), offer coverage to that employee for an equal period of time regardless of the number of hours worked during that period as long as the employee is still employed.

The law has no effect on the eligibility of employees currently in an employment category that is eligible for healthcare coverage. Under the ACA, employees that are not already health-benefit eligible may now qualify for medical insurance. Examples of employees that may now qualify for medical insurance include: adjunct faculty, contract employees, student workers, and other temporary employees.

The information below explains how the ACA will affect our current faculty, staff and students, and things to consider when hiring. The information is based on the most recent guidance from federal agencies and will be updated as necessary.

II. Terms & Definitions

A. Hours of Service:

An hour of service is each hour for which an employee is paid, or entitled to payment, for the performance of duties or for a period of time during which no duties are performed due to vacation, holiday, illness, incapacity (including disability), layoff, jury duty, military duty or leave of absence.

B. ACA Full-time Employee:

- At time of hire: An employee who, at the time of hire, is “reasonably expected” to be employed for 30 hours or more per week on average. Health insurance coverage must be offered—excludes seasonal employees.

- Subject to Measurement: An employee whose service hours, after a review during the applicable measurement period, is determined to have averaged 30 hours or more per week. (Must be offered health insurance coverage regardless of current service hours expected)

C. ACA Part-time Employee:

An employee who is “reasonably expected” to be employed on average less than 30 hours per week, based on the facts and circumstances at the time of hire; subject to hours of service measurement.

D. Evergreen Employee:

An employee who is employed in a health-benefit eligible employee class and will not have hours of service measured for ACA purposes.

E. Variable-Hour Employee:

An employee whose hours are expected to fluctuate during employment, including all non-evergreen employees. All variable-hour employees shall be subject to hours measurement.

- Selected Hourly Employee: A student employee or a regular employee who is employed half-time or less.

- Temporary Employee: An employee who is expected to be employed for five months or less with pre-determined minimum breaks between periods of employment (see section III-B-2).

- Contract Employee: An employee is who an adjunct faculty or staff contract/project based (see section III-B).

F. New Employee/Rehire:

An employee that is either new to the employer or an employee who resumes work after a pre-determined minimum break of 4 to less than 26 weeks, or a break of 26 weeks or more.

G. Ongoing/Continuing Employee:

An employee that has been employed for at least one complete standard measurement period without a qualifying break in service.

H. Employment Break Period:

A period of at least four consecutive weeks, during which an employee has no hours of service. There are specific rules that regulate the length of these breaks in educational organizations (see section III-D for complete information).

- Qualifying break: A break which qualifies an employee to be considered a rehire, initiating a new IMP (see below).

- Non-qualifying break: A break which does not qualify them to be considered a rehire; classification remains ongoing/continuing.

I. Measurement Periods

(also referred to as the “look back period”):

-

Measurement Period – the period of time during which a variable-hour employee’s hours are measured to determine potential future eligibility for access to ACA healthcare coverage. Employee must not have a qualifying break in service of 4 to less than 26 weeks during this time period.

- Initial Measurement Period (IMP): For new employees, the initial 12-month measurement period will begin on the first of the month after the employee’s hire date.

- Standard Measurement Period (SMP): For ongoing employees, this is a 12-month period beginning at the same time of year for all variable-hour employees.

J. Administrative Period:

-

Administrative Period – the period of time allowed for employers to take administrative steps to evaluate eligibility and to complete the benefit enrollment process.

- Initial Administrative Period (IAP): For new employees, the initial measurement period and the administrative period combined cannot exceed 13 months from the beginning of the employee’s IMP.

- Standard Administrative Period (SAP): For ongoing employees, this is the period immediately following the end of the standard measurement period and ending immediately before the start of the associated stability period.

K. Stability Periods:

-

Stability Period – the period of time following the Administrative Period where, if the variable hour employee was determined to be “ACA Full-time”, the employee is eligible for ACA healthcare coverage regardless of hours worked during this period, so long as they remain employed in any capacity. This period is of equal length to the Measurement Period.

- Initial Stability Period (ISP): For new employees, this is the 12-month period beginning at the end of the IAP.

- Standard Stability Period (SSP): For ongoing employees, this is a 12-month period beginning at the same time of year for all variable-hour employees deemed eligible for coverage.

III. Hiring/Employment

A. Eligibility

- Immediate eligibility – if a variable-hour employee is expected, at the time of being newly hired or appointed, to be employed an average of 30 hours per week or more, the employee will become immediately eligible to enroll for healthcare coverage, effective on the corresponding eligibility date. If the employee at any point within the IMP, due to a change in assignment or status, is expected to be employed an average of 30 hours per week or more, they also become immediately eligible for coverage.

- Eligibility subject to measurement – variable-hour employees who do not qualify for immediate eligibility are subject to a measurement period. If during the administrative period it is determined that they incurred service hours of 30 hours or more per week during the measurement period, they will be eligible for coverage beginning with the corresponding stability period.

B. Affected Employee Classifications (ECLS)

Variable-hour Employees

The procedures below are meant to highlight the types of earnings that are typical for each of these employment classes. Measurement takes into account hours worked across all university jobs and it is between the employee and the department to ensure that all job types are taken into account in determining weekly service hours.

- Part-time Regular Employees (ECLS: HU, HH)

Regular hourly under half-time and half-time employees will be measured to ensure that they are under ACA full-time for all positions on campus.

Reporting procedure: All service hours must be reported through the time clock system.

- Temporary Non-student Employees (ECLS: TP, TF, TS)

Temporary assignment(s) that is for five months or less. Initial eligibility and measurement rules will apply.

Reporting procedure: All service hours must be reported through the time clock system.

- Full-time: An employee who is reasonably expected to be employed for 30 hours or more per week; an administrative decision was reached to no longer hire full-time temporary employees (see the only exempting provision below in “Seasonal employees”).

- Part-time: An employee who is reasonably expected to be employed less than 30 hours per week.

- Seasonal employee: An employee who is reasonably expected to be employed for 30 hours or more per week in a position for which the customary annual employment is five months or less and that period should begin each calendar year in approximately the same part of the year, such as summer or winter (academic year employees of educational organizations cannot be treated as seasonal employees)

- Adjunct Faculty (ECLS: FC, ZC)

Employees who are contracted to teach courses, including student employees who are the teacher of record, are considered adjunct faculty. ACA allows the university to calculate service hours based on credit hours. AU uses a formula that applies a 3:1 ratio of service hours (per week) to credit hours taught. The 3.0 hours includes 2.25 hours for class/prep/grading time plus 0.75 hours for time outside of the classroom, e.g. office hours/faculty meeting time. Campus teaching load must be less than 10 credit hours per semester—exceptions may be allowed with the understanding that they may trigger eligibility.

Reporting procedure: Submit a completed faculty contract form (MUST use current form, old forms will NOT be accepted), indicating number of credits and total hours of service based on the 3:1 formula.

- Student Employees (ECLS: ZR)

Student positions are expected to be paid on an hourly basis, with limited exceptions (e.g. student teaching contracts, RA stipends). Student employees are considered variable-hour employees with the intent that they will work an average of less than 30 hours per week and will have their hours measured during the corresponding measurement period (IMP/SMP). Regular semester hours are still limited to 20 hours per week, with the ability to work up to full-time (caution if exceeding 40 hours per week) during the breaks, including summer breaks. New student employees cannot be expected to work 30 or more hours per week during their IMP. Other than work-study hours, all student hours will be counted towards hours of service for the measurement period.

Reporting procedure: All service hours must be reported through the time clock system for hourly positions. Exceptions of non-hourly student positions will require appropriate documentation indicating hours of service per week.

- Non-Student Project-Pay/Contract (non-teaching) (ECLS: SC)

A non-student employee may be contracted to complete a specific project. The tasks and duties must qualify as exempt (non-hourly) type of work and meet the salary minimum test of $455 per week. Department must indicate how many expected service hours per week will be worked.

Reporting procedure: Submit a completed staff contract form (MUST use current form, old forms will not be accepted), indicating expected number of hours of service per week; will be treated as salaried employee.

- One-Time Payment (OTP) Requests

For payment of service time not already accounted for through other earnings, OTP requests require hours of service information for all employees (including salaried) for payment to be processed. Payment must meet minimum wage requirement and may cause overtime expenses to be incurred.

Reporting procedure: Submit the OTP form indicating service hours by week of (beginning date of the week) for the work period being paid (e.g. 18 hours for the week of 10/04/15). It must be reported in the pay period worked.

C. Changes in Employment

-

Change in Employment Class/Status:

- If during their initial measurement period a new variable-hour employee experiences a change in employment status that indicates they are reasonably expected to be full-time, healthcare coverage must be offered.

- If an ongoing variable-hour employee experiences a change in employment status before the end of a stability period, the change will not affect the ACA healthcare eligibility status for the remainder of that stability period.

-

Change/Addition in Employing Department (cost sharing):

- If a variable-hour employee working in Department A is determined to have been employed at least 30 hours/week during a measurement period but for the associated stability period moves to Department B (or B & C, etc.) with service hours under 30 hours/week, Department A will be contacted by the finance/budget office regarding the additional unbudgeted expense.

- If two departments contributed to the hours worked during the measurement period where a variable-hour employee is determined to have been employed at least 30 hours/week during a measurement period, both departments will contacted by the finance/budget office regarding the additional unbudgeted expense, regardless of where the employee is currently working.

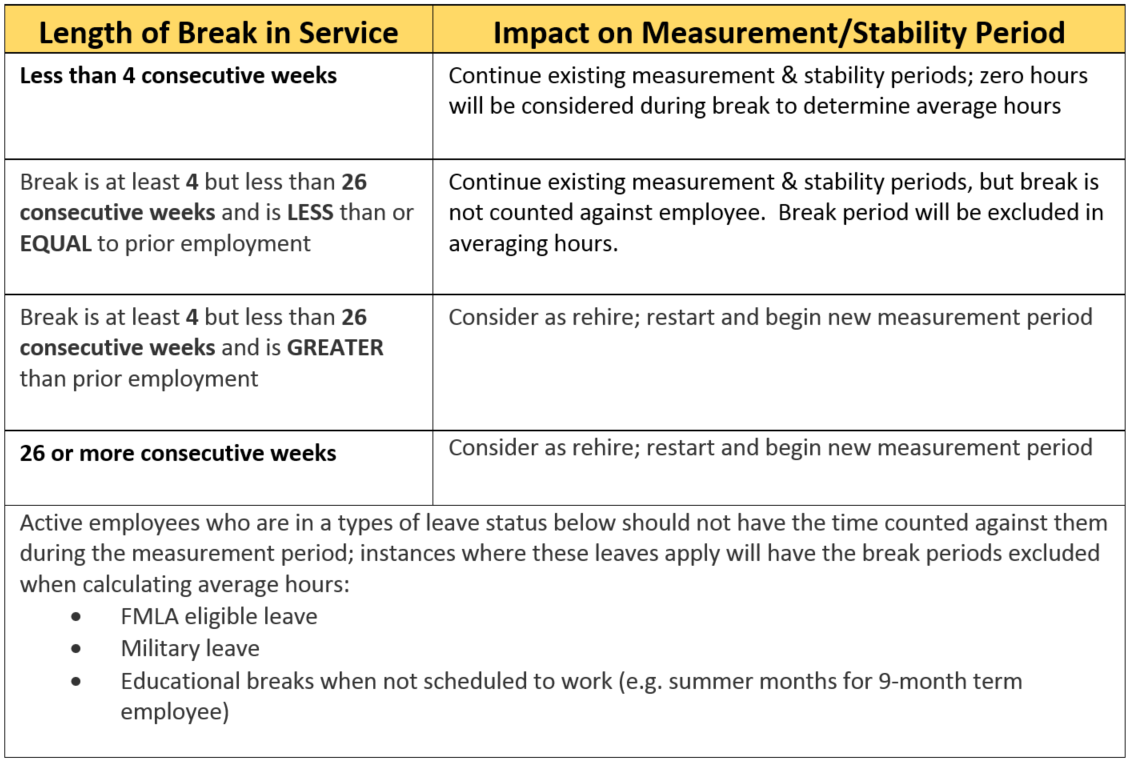

D. Breaks in service

- An employee who resumes providing services to an employer after a period during which the employee was not credited with any hours of service may be treated as having terminated employment and having been rehired. Such an employee is treated as a new employee upon the resumption of services, only if the employee did not have any hours of service for a period of at least 26 consecutive weeks (for educational organizations).

- In addition, a parity rule states that an employee may be considered a rehire after a shorter period of at least four consecutive weeks during which no hours of service were credited, if that break period exceeds the prior employment period.

- In no case will a break of less than four consecutive weeks qualify an employee to be considered a rehire; zero service hours will be credited to that break when determining average hours for the measurement period.

- In the case where a break in service is greater than four consecutive weeks but less than a predetermined qualifying break (see 1 and 2 above), the break(s) will not affect the employee’s existing measurement period. The employee’s average hours of service for the measurement period will be determined by excluding the break period(s) from the calculation.

- To ensure that we can appropriately calculate breaks, job begin and end dates must reflect accurate data in a timely manner. This applies to all employee classifications, including students (i.e. students should be terminated over the summer and during study or student missions abroad). HR will be taking steps to prompt departments when an employee goes unpaid during a pay period.

- Chart:

-

Examples:

- Employee worked and reported hours for 2 weeks, terminated employment for 3 consecutive weeks without paid time, worked for 26 weeks and then terminated employment for 1 week without paid time, then worked for 20 weeks

Because the employee did not have four consecutive weeks of unpaid time, regardless of the first break being longer than the prior employment period, all weeks are included when calculating the average hours worked during the measurement period. Employee is not considered a rehire.

Average hours worked = Total hours / 52 weeks

- Employee worked for 16 weeks, terminated employment for 12 weeks, was rehired, then worked another 24 weeks

Because the break period is greater than 4 consecutive weeks but less than 26 weeks, and less than the 16 weeks of prior employment, the 12-week break period cannot be included when calculating the average hours worked during the measurement period. Employee is not considered a rehire.

Average hours worked = Total hours / 40 weeks

- Employee worked for 30 weeks, terminated employment for 28 weeks, then was rehired

Because the break period is greater than 26 weeks, the employee is considered a rehire and the weeks worked prior to the termination are not considered.

Begins a new 12-month IMP starting from the first day of the month following the rehire

- Employee worked for 15 weeks, was on unpaid Family and Medical Leave for 3 weeks, then worked for 34 weeks

Family and Medical Leave is considered a special type of unpaid leave. Therefore, the calculation is based only on the weeks the employee actually worked.

Average hours worked = Total hours / 49 weeks

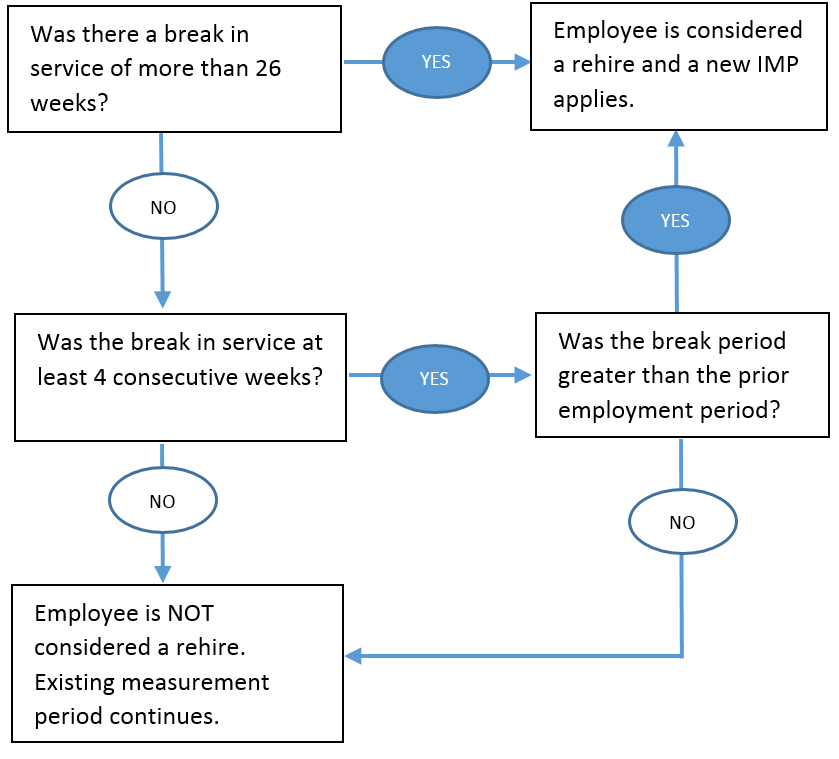

- Decision Tree: Determining Break Period Eligibility

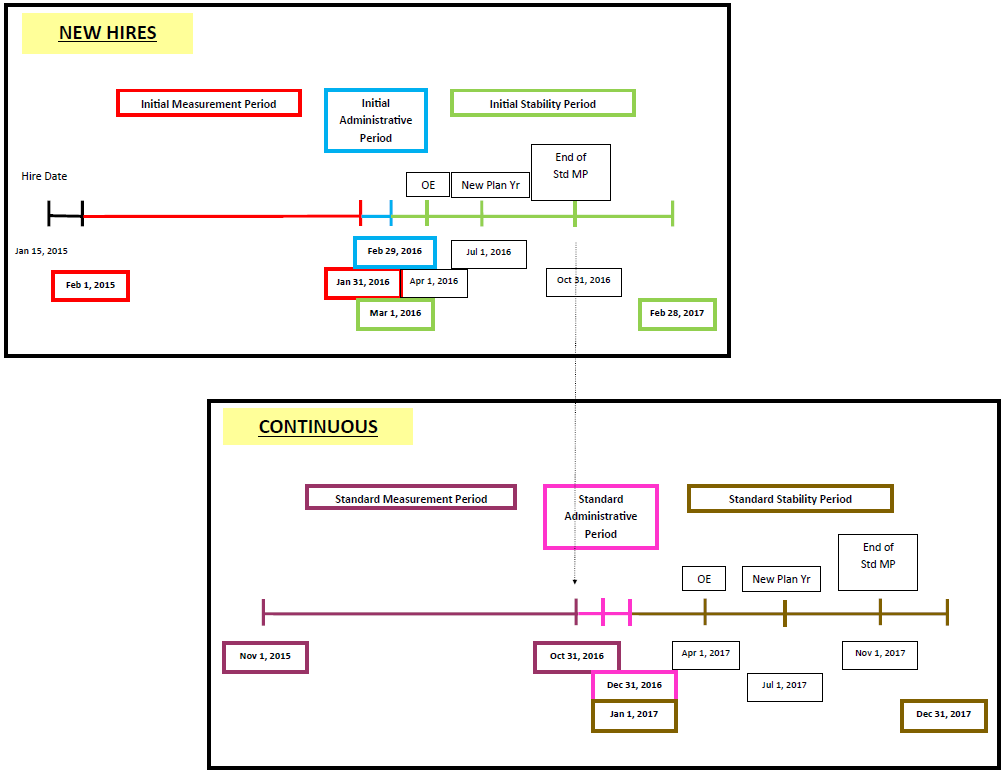

IV. ACA Periods

A. Measurement/Look-Back:

- Initial Measurement Period (IMP) is 12 months from the first of the month after date of hire or returning after a qualifying break

- Standard Measurement Period (SMP) is the 12-month period November 1–October 31

B. Administrative:

- Initial Administrative Period (IAP) is 1 month starting the end of the IMP

- Standard Administrative Period (SAP) is the 2-month period November 1–December 31

C. Stability:

- Initial Stability Period (ISP) is the 12-month period beginning the 14th month from the beginning of the IMP

- Standard Stability Period (SSP) is the 12-month period January 1–December 31

D. ACA Periods Graphic

V. Healthcare Coverage

A. Description

- Variable-hour employees who are eligible under ACA will be offered the same health plan options offered to evergreen employees: Premier Plan, Standard Plan, and Qualified High-Deductible Plan (opt-out payment available also). Both ACA minimum value and affordability requirements have been met.

- ACA only applies to health coverage (with corresponding Flex Spending and/or Health Savings Account option). Employees who elect or continue health coverage under ACA will also receive prescription drug coverage, but will not be eligible for other employee benefit plans such as dental vision.

- Qualifying employees will be able to cover dependents on the plan.

- For new variable-hour employees that become ACA health-benefit eligible as a result of measurement, coverage will be effective at the beginning of the ISP, which is one month after the end of the IMP. It will not be retroactive to the beginning of the IMP.

- For ongoing variable-hour employees that become ACA health-benefit eligible as a result of measurement, coverage will be effective at the beginning of the SSP, which is January 1, subsequent to the SAP.

- The Benefits Office will notify the employee if/when they are eligible for health coverage, and provide information regarding enrollment in a plan.

- An employee who was enrolled in a health plan before a non-qualifying break in service will be re-enrolled in the same health plan upon return during the same stability period, in which the break began.

- An ongoing variable-hour employee who is eligible and covered remains so for the full 12-month stability period, regardless of reduction of hours, as long as employment is maintained and premiums are paid (note: lapse in premium payments may result in termination of coverage).

B. Cost

- Departments who have a variable-hour employee that is measured to have worked 30 hours or more per week will be contacted by the finance/budget office. As additional unbudgeted expenses will now be incurred due to the required coverage offered to the employee, any additional measures and procedures to be taken will be discussed.

- Eligible employees who enroll in health benefits will pay the corresponding premium, through payroll deductions, based on their plan selection and dependent coverage.